how do i pay my personal property tax in richmond va

Commissioner of the Revenue Email the Commissioners Office Physical Address 9901 Lori Road Building 38 Room 165 Chesterfield VA 23832 Directions Mailing Address PO. Voucher 2-4 payments are processed by the Richmond County Treasurer.

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Our app will find out if you have all the qualifications to reduce your property tax expenses in the Old Dominion.

/cloudfront-us-east-1.images.arcpublishing.com/gray/4ASPKZIKKZEKDBCSG3BYAZNXBM.jpg)

. Box 27412 Richmond VA 23269. We will try to answer them soon. When you use this method to pay taxes please make a separate payment per tax account number.

If you have questions about your personal property bill or would like to discuss the value assigned to your vehicle please contact the Department of Finance by phone at 804 501-4263 email at taxhelphenricous or fax at 804 501-5288. Virginia Department of Taxation For additional forms or information on other tax related items please contact the Virginia Department of Taxation at 1-804-367-8031. To pay the current Personal Property bill only or to add a bill using another Web application press the Checkout button.

Personal Property Tax Relief Does Your Vehicle Qualify for Personal Property Tax Relief. Homes are valued. County homeowners pay a median property tax of 1880.

The current rate is 350 per 100 of assessed value. As June 5 falls on a Sunday all payments postmarked on or before June 6 will not be subject to penalties and interest for late payment. If a vehicle is subject to the taxes in Alexandria for a full calendar year the tax amount is determined by multiplying the tax rate by the assessed.

Back to Top View Bill Detail Screen Checkout Pay another PP Bill Return to Search. The current rate for Personal Property Taxes is 4. The personal property tax is calculated by multiplying the assessed value by the tax rate.

The personal property tax rate set annually by City Council is 345 per 100 of assessed value or 345 except for Aircraft which is taxed at a rate of 106 per 100 assessed value or 106 Aircraft 20000 pounds or more are taxed at a rate of 45 cents per 100 of assessed value. Paying Your Property Taxes Payment Options Online by Credit Card service fees apply Paying at your Financial Institution Online Banking Property Pre-Authorized Withdrawal PAWS Drop Box at City Hall By Mail In Person at City Hall Online Credit Card Payment Service Fees Apply. Visit the departments website at dredosdofgov or call 804 501-4263 for your Personal Property Tax Division needs.

Creditdebit card payments will incur a processing fee. 804-748-1281 Fax Numbers 804-768-8649 Administration Individual Personal Property Income Tax Tax Relief. Does the leasing company pay the tax without reimbursement from the individual.

If the information shown is incorrect press the Return to Search button and return to the Pay Real Estate Taxes Online screen. Richmond VA 23219 USA Finance Disclosures Freedom of Information Act FOIA Independent Municipal Advisor Exemption Useful Links Click Here to Apply for Finance Jobs Better Business Bureau City of Richmond Code Commonwealth of Virginia. Pay Real Estate Tax.

You have the option to pay by credit card or electronic check. All payments should be made payable to the Richmond County Treasurer. Payment by check or creditdebit card can be made online.

You can pay your personal property tax through your online bank account. The Personal Property Tax rate is 533 per 100 533 of the assessed value of the vehicle 355 for vehicles with specially-designed equipment for disabled persons. Mail the 760-PMT voucher with check or money order payable to Virginia Department of Taxation to.

The personal property tax rate is determined annually by the City Council and recorded in. For Personal Property Tax Payments Feel free to contact the office should you have any questions 804-333-3555. Qualifying farmers fishermen and merchant seamen should use the 760-PFF voucher.

Which lies on the opposite side of the James River and the city of Richmond. An e-check payment does not incur any charges. Pay by Phone You can make Personal Property and Real Estate Tax payments by phone.

Taxpayers can either pay online by visiting RVAgov or mail their payments. Box 124 Chesterfield VA 23832 Phone. Personal Property Tax Rates Vehicles Autos trucks motorcycles and utility trailers are assessed on a prorated basis using the National Automobile Dealers Associations Blue Book NADA.

You only need to follow these fours steps. There is a convenience fee for these transactions. Virginia Department of Taxation PO.

Administrative fees DMV stop fees lien fees and insufficient fund fees can also be added as applicable to all delinquent accounts that are more than 30 days past due. A 10 penalty and interest of 10 APR will be assessed on the day following each due date. Also if it is a combination bill please include both the personal property tax amount and VLF amount as a grand total for each tax account number.

Personal property tax bills have been mailed are available online and currently are due June 5 2022. Can I Pay My Virginia Car Tax Online. Pay Property Taxes Pay Personal Property Taxes Offered by City of Richmond Virginia 804646-7000 PAY NOW Pay Personal Property Taxes in the City of Richmond Virginia using this service AD AD Community QA You can ask any questions related to this service here.

Directly from your bank account direct debit ACH credit initiated from your bank account Credit or debit card Check or money order Main navigation Payments Penalties Audits Bills Payments Individual Tax Payments Business Tax Payments Credit Card Payments. Based on the type of payments you want to make you can choose to pay by these options. Personal Property Tax.

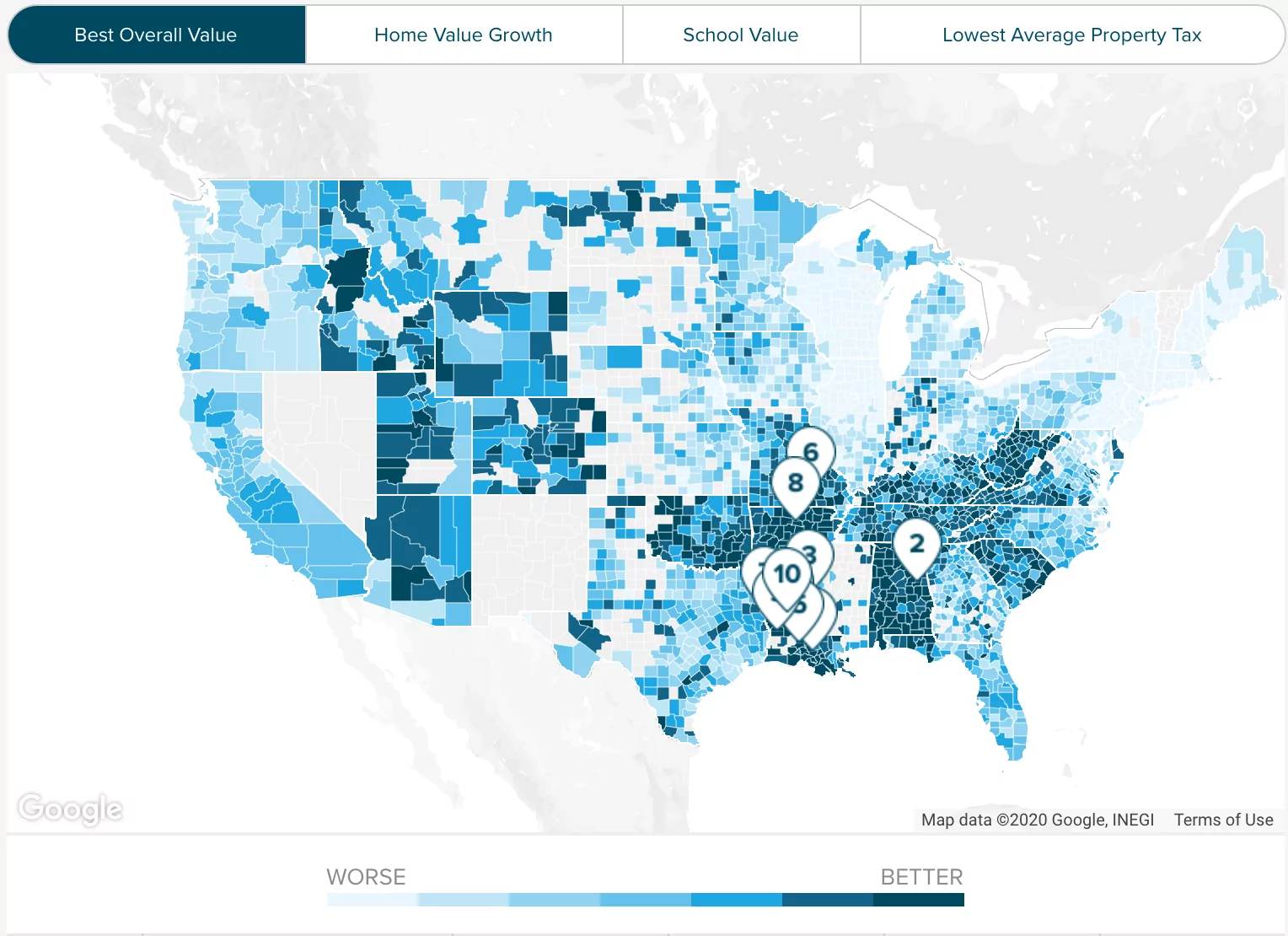

Access DoNotPay Locate and choose the Property Tax product Provide some information about the property you own Answer some questions about yourself and your property. Offered by City of Richmond Virginia. Homeowners in the state of Virginia pay property tax rates that are well below the national average of 107.

Box 1478 Richmond VA 23218-1478 Include your Social Security number and the tax period for the payment on the check.

Real Estate Tax Exemption Virginia Department Of Veterans Services

Virginia Tax Rates Rankings Virginia State Taxes Tax Foundation

Property Taxes How Much Are They In Different States Across The Us

Soaring Home Values Mean Higher Property Taxes

City Of Richmond Extends Personal Property Tax Deadline To August Wric Abc 8news

/cloudfront-us-east-1.images.arcpublishing.com/gray/5DJX4GFP45DOVJWLPRIWW5ETVU.jpg)

Colonial Heights Expected To Extend Due Date For Personal Property Tax Bill To July 29

New York Property Tax Calculator Smartasset

Taxmaster Finance Consulting Psd Template Tax Consulting Finance Business Tax

Real Estate Tax Frequently Asked Questions Tax Administration

Pay Online Chesterfield County Va

/cloudfront-us-east-1.images.arcpublishing.com/gray/WPM3BLSOYBGB7DP3Q4DS2QXRUU.png)

Chesterfield Provides Grace Period On Personal Property Tax Payments

How To Find Tax Delinquent Properties In Your Area Rethority

Henrico Leaders To Vote On Personal Property Tax Bill Extension

Population Wealth And Property Taxes The Impact On School Funding

Alameda County Ca Property Tax Calculator Smartasset

Population Wealth And Property Taxes The Impact On School Funding

/cloudfront-us-east-1.images.arcpublishing.com/gray/4ASPKZIKKZEKDBCSG3BYAZNXBM.jpg)

Richmond Personal Property Tax Payment Deadline Extended Until Aug 5