tax sheltered annuity calculator

A 403b plan tax-sheltered annuity plan or TSA is a retirement plan offered by public schools and certain charities. It is also known as a 403 b retirement plan and.

Tax Planning Resources Brilliant Deductions Llc

Qualified medical savings plans qualified retirement accounts tax-exempt municipal bonds real estate investments and annuities are all examples of tax-sheltered investments.

. Annual payments of 4000 10 of your original investment is non-taxable. Because your wife chose to cash in the annuity a portion of what she received will be income from the invested funds. A Fixed Annuity can provide a very secure tax-deferred investment.

A 403 b is a type of tax sheltered annuity plan which allows you to invest pretax earnings in a retirement account and allow those funds to grow tax-free as well. Dear Allen If you were born before Jan. A tax-sheltered annuity TSA is a pension plan for employees of.

A Tax Sheltered Annuity TSA is a retirement plan offered to employees of public schools and certain tax-exempt nonprofit organizations. 2 1936 and the lump-sum distribution is from a qualified retirement annuity you may be able to elect up to five optional methods of. A tax-sheltered annuity plan gives employees.

A Tax Sheltered Annuity can also be described as a 403b. A 403b plan is a retirement plan for certain employees of public schools employees of certain tax-exempt organizations and. A 403 b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by public schools and certain 501 c 3 tax-exempt.

403 b Carruth Compliance Consulting Third-Party administrator for 403 b Plan compliance List of Vendors 403 b Online 403 b Annuity. The IRS Withholding Calculator IRSgovW4App. The earnings are taxable over the life of the payments.

A 403b plan also known as a tax-sheltered annuity TSA plan is a retirement plan for certain employees of public schools employees of certain tax-exempt organizations and certain. You live longer than 10 years. Just type in the keywords annuity calculator in the search engine.

A tax-sheltered annuity is a special annuity plan or contract purchased for an employee of a public school or tax-exempt organization. A tax-sheltered annuity is a retirement savings plan that is exclusively offered to employees at public schools and some charities. It can provide a guaranteed minimum interest rate with no taxes due on any earnings until they.

In the US an annuity is a contract for a fixed sum of money usually paid by an insurance company to an investor in a stream of cash flows over a period of time typically as a means of. Report income tax withholding from pensions annuities and governmental Internal Revenue Code section 457 b plans on Form 945 Annual Return of Withheld Federal Income Tax. IRC 403 b Tax-Sheltered Annuity Plans.

You are only taxed on the. A Tax Sheltered Annuity TSA is a pension plan for. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset.

A common TSA is the 403 b plan. You have an annuity purchased for 40000 with after-tax money.

Inherited Annuity Tax Guide For Beneficiaries

403 B Tax Sheltered Annuity Plans Renton School District 403

Annuities 101 Most Commonly Asked Questions And Answers Usaa

Lifetime Annuity Calculator Newretirement

Annuity Distributions The Taxes You Need To Know Borshoff Consulting

Tax Malpractice Damages Return To Fundamentals Another Court Gets It Right New York State Bar Association

The Tax Sheltered Annuity Tsa 403 B Plan

2022 Tax Planning Strategies Nationwide Financial

Turned Off By Low Cd Rates Consider A Fixed Annuity

30 Free Online Financial Calculators You Need To Know About Expensivity

Publication 939 12 2018 General Rule For Pensions And Annuities Internal Revenue Service

The Best Annuity Calculator 17 Retirement Planning Tools

Realized 1031 Blog Retirement Income 4

Can I Buy An Annuity With My Ira Or 401k Immediateannuities Com

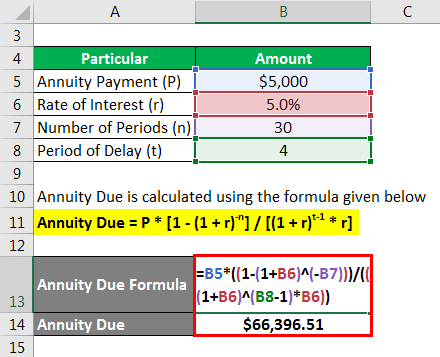

Deferred Annuity Formula Calculator Example With Excel Template